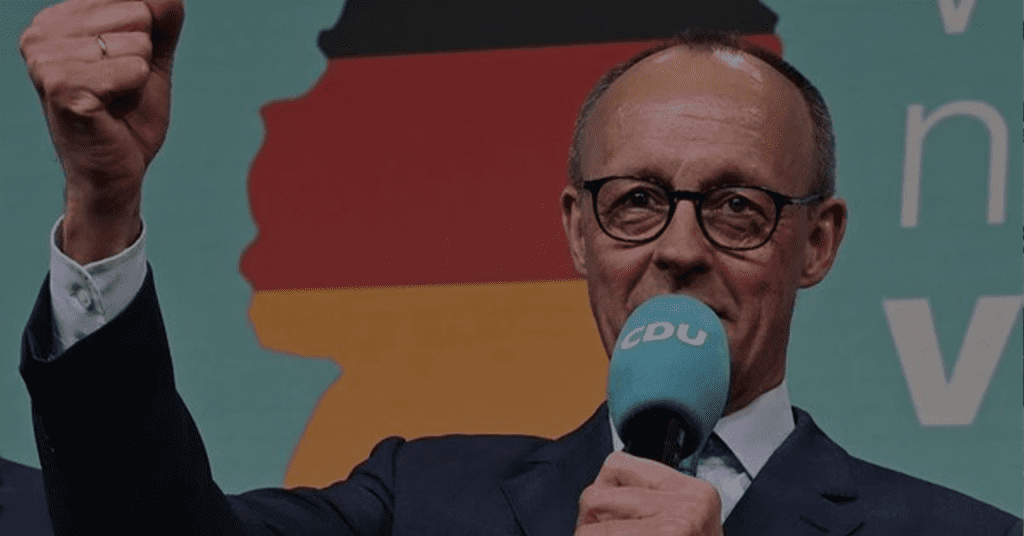

- Friedrich Merz’s CDU has won Germany’s election, but coalition talks could delay government formation and policy direction.

- Euro traders are watching the 61.8% to 50.0% Fibonacci zone as uncertainty over Germany’s political landscape weighs on the currency.

Polls have now closed in Germany’s parliamentary elections.

Exit polls indicate Friedrich Merz’s center-right Christian Democratic Union (CDU) has secured a clear victory, positioning him as Germany’s next chancellor.

The far-right AfD is projected to achieve its best result yet, currently in second place with 20.2%, nearly doubling its 2021 support. However, the Bundestag’s composition remains uncertain, and Merz has ruled out cooperation with the AfD.

Prolonged coalition talks could lead to a government divided on economic recovery and international policy, which could be bearish for the euro. With this in mind, the 61.8% to 50.0% Fibonacci zone could be an area of interest, which coincides with flattening longer moving averages.

For the exact date and time of these major economic events, import the BlackBull Markets Economic Calendar to receive alerts directly in your email inbox.